Analysis of Trades and Tips for Trading the British Pound

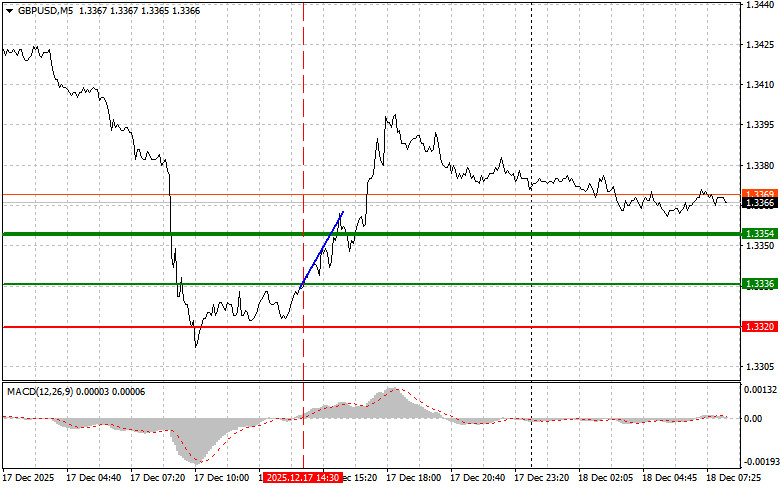

The price test at 1.3336 occurred when the MACD indicator was beginning to move upward from the zero mark, confirming an appropriate entry point for buying the pound. As a result, the pair increased by 20 pips.

The sharp decline in UK inflation led to a decline in the British pound. However, bulls managed to reclaim their positions in the second half of the day. Several factors likely triggered the sudden reversal. Firstly, the decline in the pound reached critical levels, prompting stop-loss orders to trigger and attracting short-term buyers looking to capitalize on a rebound. Secondly, traders may have concluded that the initial reaction to the inflation data was excessive, particularly given the Bank of England's monetary policy meeting today.

The consensus among experts predicts a drop in the rate to 3.75%, which is already partially priced into the current market quotes. However, the accompanying monetary policy statement and the subsequent remarks from the BoE governor, Andrew Bailey, are of prime importance. Traders will closely analyze every statement, trying to anticipate the central bank's future strategy. The assessment of the current state of the British economy, inflation prospects, and the impact of global threats on the country's financial stability will be particularly valuable.

Regarding the intraday strategy, I will focus on executing Scenarios No. 1 and No. 2.

Buy Scenarios

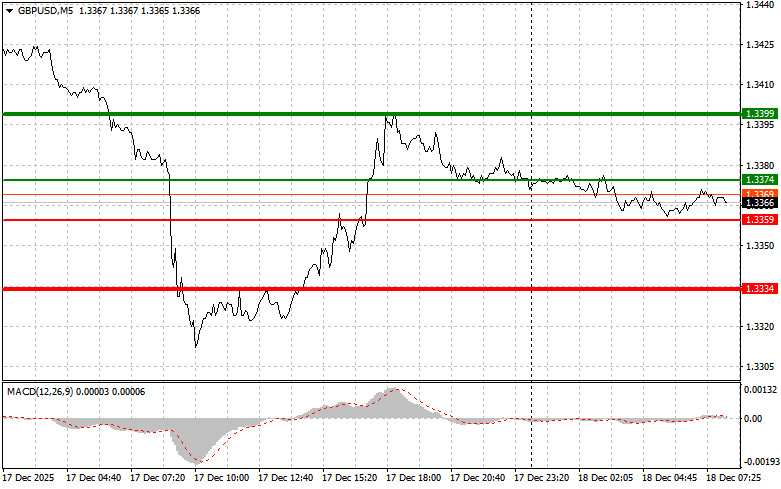

Scenario No. 1: I plan to buy the pound today when it reaches the entry point around 1.3374 (green line on the chart), targeting a move to 1.3399 (thicker green line on the chart). At 1.3399, I plan to exit the market and open short positions in the opposite direction, anticipating a move of 30-35 pips back from this level. We can only expect strong pound growth following the central bank's firm stance. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today if there are two consecutive tests of 1.3359 while the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal upwards. An increase towards the opposite levels of 1.3374 and 1.3399 can be expected.

Sell Scenarios

Scenario No. 1: I plan to sell the pound today after breaking the level of 1.3359 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.3334 level, where I plan to exit short positions and immediately open longs in the opposite direction, anticipating a 20-25-pip move back from this level. Pound sellers will return if the BoE adopts a dovish stance. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning its decline from it.

Scenario No. 2: I also plan to sell the pound today if there are two consecutive tests of 1.3374 while the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downwards. A decline towards the opposite levels of 1.3359 and 1.3334 can be expected.

What is on the Chart:

- Thin Green Line: Entry price at which to buy the trading instrument.

- Thick Green Line: Estimated price at which a take profit can be set, or profit realized, since further growth above this level is unlikely.

- Thin Red Line: Entry price at which to sell the trading instrument.

- Thick Red Line: Estimated price at which a take profit can be set or profit realized, since a further decline below this level is unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making entry decisions. It is best to remain on the sidelines before significant fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, you must have a clear trading plan, similar to the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.