Global equities extend their rally

Stock markets remain buoyant. Japan and Taiwan posted fresh record highs, while China's blue chips reached their strongest levels in ten months.

Earnings season lifts Europe and Wall Street

European futures added around 0.2 percent, mirroring gains in US contracts. Investor sentiment was boosted by a robust reporting season. According to Goldman, earnings per share for the S&P 500 grew 11 percent year-on-year, with 58 percent of companies raising full-year forecasts.

Retail giants in the spotlight

This week will shed light on consumer spending trends as Home Depot, Target, Lowe's and Walmart release their quarterly results.

Spotlight on Jackson Hole

The highlight for monetary policy watchers will be the annual Federal Reserve symposium in Jackson Hole. On Friday, Fed Chair Jerome Powell is expected to deliver remarks on the economic outlook and monetary stance. A Q&A session, however, does not appear to be on the agenda.

The event will also feature European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey in panel discussions.

Rates and bond market tensions

Futures currently price in roughly an 85 percent chance of a Fed rate cut in September. Any shift toward a less dovish tone from Powell could weigh heavily on bond markets.

While short-term yields remain elevated due to Fed expectations, long-term investors continue to worry about inflation, fiscal deficits and the politicization of monetary policy — concerns that are steepening the yield curve.

European bonds react to rising defense costs

Yields on European government bonds continued to climb, partly reflecting expectations that governments will need to borrow heavily to finance expanding defense budgets.

Asia opens the week with cautious optimism

Asian equity markets posted modest gains on Monday ahead of a week expected to be pivotal for US interest rate policy. Oil prices, meanwhile, slipped as the perceived risks to Russian supply appeared to ease.

Record highs in Japan and Taiwan

A stronger appetite for risk pushed Japanese and Taiwanese stock benchmarks to fresh all-time highs. In China, blue chip shares advanced to their strongest level in ten months.

Fed rate cut expectations

Investors currently assign about an 85 percent probability to a quarter-point cut at the Federal Reserve's September 17 meeting, with further easing anticipated by December.

Cheaper borrowing supports equities

The prospect of lower global borrowing costs underpinned stock markets. Japan's Nikkei gained 0.9 percent, reaching yet another record high.

Mixed moves across Asia

The MSCI Asia-Pacific ex-Japan index edged lower after touching a four-year peak last week. Chinese blue chips rose another 1 percent, extending their quarterly gain to nearly 8 percent.

European and US futures extend gains

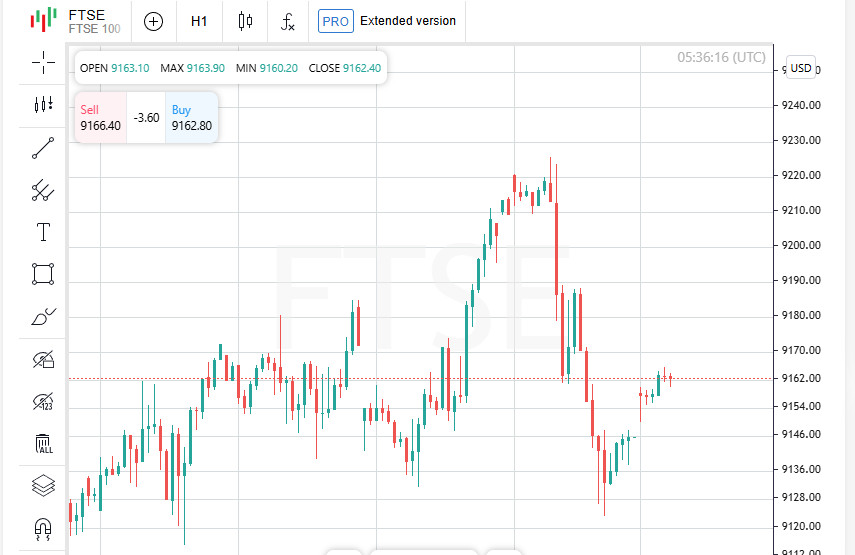

Eurozone futures showed modest strength, with EUROSTOXX 50 and FTSE both up 0.2 percent and DAX futures advancing 0.1 percent. US markets mirrored the trend: S&P 500 futures rose 0.2 percent, while Nasdaq futures gained 0.3 percent, hovering near record territory.

Earnings season boosts market confidence

Investor sentiment was bolstered by a strong earnings season. S&P 500 companies reported an 11 percent year-on-year increase in earnings per share, with 58 percent of firms raising their annual forecasts.

Tech giants keep outperforming

According to Goldman Sachs analysts, the earnings of the largest technology companies remain outstanding. Even before Nvidia publishes its results, the so-called Magnificent Seven are estimated to have boosted earnings per share by 26 percent year-on-year in the second quarter, beating pre-season consensus forecasts by 12 percent.

Spotlight on consumer demand

This week will be crucial in assessing household spending power, with key earnings reports expected from Home Depot, Target, Lowe's and Walmart.

Bond markets under pressure

Expectations of a Federal Reserve rate cut have capped short-term Treasury yields, while long-term bonds remain under pressure from stagflation concerns and the mounting budget deficit. This dynamic has created the steepest yield curve since 2021.

European debt markets are facing similar challenges. Anticipation of heavier borrowing to fund defense budgets has pushed German long-term bond yields to their highest levels in 14 years.

Dollar weighed down by Fed expectations

The prospect of looser Fed policy weakened the US dollar, which slipped 0.4 percent against a basket of major currencies last week to 97.851. The greenback firmed slightly versus the yen to 147.46, while the euro held steady around 1.1701 after gaining 0.5 percent in the previous week.

The dollar performed strongest against the New Zealand currency, amid expectations that the Reserve Bank of New Zealand will cut rates to 3 percent on Wednesday.

Commodities show mixed signals

In commodities, gold hovered at 3343 dollars per ounce after a 1.9 percent weekly loss.

Oil prices faced resistance after Donald Trump backed away from threats to impose new restrictions on Russian exports. Brent crude slipped 0.2 percent to 65.74 dollars a barrel, while US crude eased 0.1 percent to 62.76 dollars.