Wall Street ends lower as tariff worries weigh on sentiment

US stock markets closed in the red on Tuesday as investors grew increasingly concerned about the risks associated with trade tariffs. Corporate reports heightened these concerns, with companies such as Yum Brands highlighting the negative effects of tariffs on financial results and future outlooks.

Imports decline, and trade deficit narrowsAccording to the latest data, the US trade deficit shrank in June, driven by a notable drop in consumer goods imports. The decline in the trade gap with China was especially striking, falling to its lowest level in 21 years.

Service sector under tariff pressureUS service sector activity also showed signs of weakening in July, with more companies reporting that import tariffs were driving up production costs and hurting business activity.

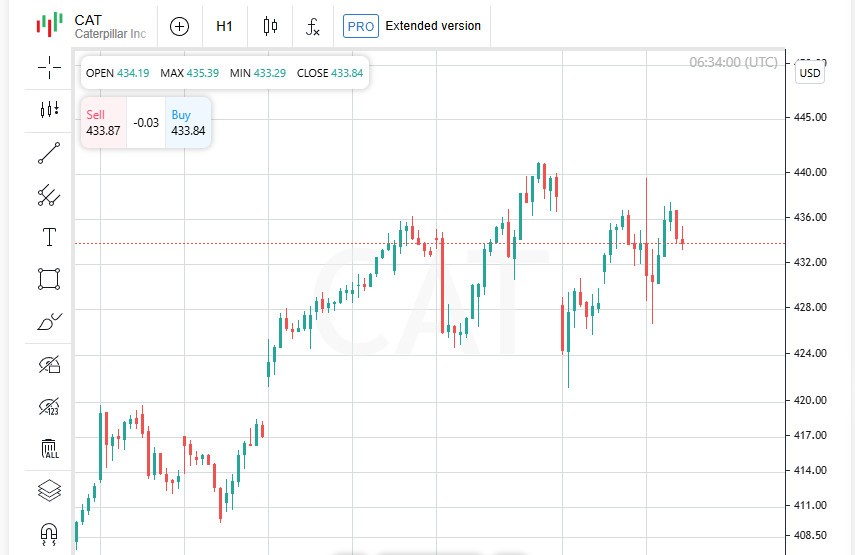

Corporate reports raise red flagsSecond-quarter earnings reports reflected the consequences of US tariff policy. Shares of Yum Brands, which operates chains like KFC, fell by 5.1% after the company failed to meet market expectations due to weakened consumer demand from elevated tariffs.Caterpillar also issued a cautionary note, estimating that US tariff costs could reach $1.5 billion in 2025. Despite this, its shares dipped only 0.1%.

Most companies still exceed expectationsOn a positive note, about 80% of S&P 500 companies have reported results above analyst expectations, helping to maintain an overall upbeat market backdrop.

Markets fall into redBy the close of trading, the Dow Jones index had dropped 61.9 points (0.14%) to 44,111.74. The S&P 500 fell 30.75 points (0.49%) to 6,299.19. The Nasdaq declined 137.03 points (0.65%) to 20,916.55.

Trump signals new tariffs: Pharma and semiconductors in focusOn Tuesday, Donald Trump made comments that shook the financial markets once again. He said the US is considering introducing initial, so-called "modest" tariffs on pharmaceutical imports, with a possibility of much steeper increases in the future. He also announced that new restrictions on semiconductor and chip imports could be unveiled as early as next week.

Stock indices near record highsDespite geopolitical tensions and tough trade talk, the S&P 500 has risen 7.1% since the start of the year. Both it and the Nasdaq recently posted new record highs, reflecting strength in the tech and financial sectors.

Marriott cuts outlook amid uncertaintyCorporate earnings remain in the spotlight. Marriott International downgraded its revenue and profit forecasts for the year, citing weaker travel demand and general economic instability. Nonetheless, the stock closed slightly higher, gaining 0.2%.

Disney and McDonald's next to reportWhile earnings season is nearing its end, several major releases are still ahead. On Wednesday, reports from Walt Disney and McDonald's are expected and could influence broader market sentiment.

Asian markets follow Wall Street's dropAsian stock exchanges mirrored Wall Street's decline on Wednesday. Weak macroeconomic data from the US reinforced concerns about the harmful effects of tariffs on businesses and consumers. In this context, the US dollar began to lose ground, partly due to falling Treasury yields.

Service sector stagnates as costs riseFresh July data on the US service sector surprised analysts: business activity barely changed, while employment growth slowed further. Meanwhile, input costs hit a near three-year high, a worrying sign that Trump's tariff policy is weighing on the real economy.

Asian markets show mixed performanceOn Tuesday, Asia-Pacific stock markets closed mixed. The regional MSCI index, tracking shares outside Japan, fell by 0.2%, while Japan's Nikkei posted a modest 0.2% gain.

China and Hong Kong remain flatMainland Chinese and Hong Kong stock indexes were little changed. The CSI 300 and Hang Seng ended the day near Monday's levels, showing no clear direction.

US futures slideFutures on major US stock indices showed early losses Wednesday. Nasdaq futures dropped 0.3%, while S&P 500 futures slipped 0.1%, reflecting investor caution over foreign policy developments and continued uncertainty around US trade strategy.

Trump doubles down on tariffsPresident Trump reiterated his intent to impose new trade restrictions on semiconductor and chip imports, potentially announcing them next week. He also warned that pharmaceutical imports may soon face moderate tariffs, with the potential for sharp increases over the next year or two.

China trade talks near finish lineTrump also stated that the US is close to finalizing a trade agreement with China. He hopes to meet with Chinese President Xi Jinping by year's end if the final terms are reached. However, Trump issued a warning to India, suggesting that continued purchases of Russian oil could prompt US tariffs on Indian goods.

USD stabilizes after last week's dropIn the currency markets, the US dollar has steadied after a sharp fall at the end of last week, when weak labor data boosted expectations of a Fed rate cut in September. The US Dollar Index is now at 98.821, up 0.1% for the week, partially recovering from Friday's 1.4% plunge.

Rate cut seen as almost certainAccording to the CME's FedWatch tool, there is a 94% probability that the Federal Reserve will cut interest rates next month. Markets are also pricing in at least two rate cuts by year-end, signaling strong confidence in continued monetary easing.

Oil bounces after sharp declineOil prices have rebounded slightly after four straight days of losses. WTI rose 0.2% to $65.30 per barrel, while Brent crude edged up 0.1% to $67.78, still near its one-month low.

Trump weighing sanctionsTrump said Tuesday he would consider sanctions against countries that continue buying Russian oil. A final decision is expected after his scheduled meeting with Russian officials on Wednesday.

Gold holds steady — markets in wait modeGold prices remain unchanged, with one troy ounce still trading at $3,381. This pause in the precious metals market likely reflects investor caution as they await further macroeconomic signals.