Bitcoin is aiming for a new all-time high, currently trading above $122,000. Ethereum is also nearing its record of over $4,400, suggesting the continuation of a bullish market that appeared to lose momentum last week.

Many expected August and September—traditionally the weakest months for the cryptocurrency market—to remain the same this year, and few anticipated such sharp moves. However, contrary to pessimistic forecasts, the crypto market showed unexpected resilience, followed by impressive growth, forcing many to reconsider their outlook.

Meanwhile, BTC dominance over altcoins, after a brief pause, has resumed its sharp decline. The drop in BTC dominance this year is the steepest in three years. Against this backdrop, Ethereum has already reached a four-year high and, if the current trend continues, may break its all-time high above $4,400 in the coming days.

Just a couple of months ago, Bitcoin was the undisputed choice for entering the crypto space, but now investors are increasingly viewing Ethereum and other projects as fully-fledged investment assets offering unique technological solutions and growth potential. Considering that Ethereum still significantly lags behind Bitcoin, which has already set multiple all-time highs this year, it is unsurprising that traders are turning their attention to this undervalued asset. However, it is essential to remember that the crypto market remains volatile and unpredictable. The decline in Bitcoin dominance may signal a shift toward riskier investments, which also means increased overall market volatility. Traders should exercise caution and conduct thorough analysis before making decisions, taking into account both the potential benefits and the risks associated with investing in altcoins.

As for the intraday strategy in the cryptocurrency market, I will continue to act based on any major pullbacks in Bitcoin and Ethereum, expecting the medium-term bullish market trend to persist.

For short-term trading, the strategy and conditions are described below.

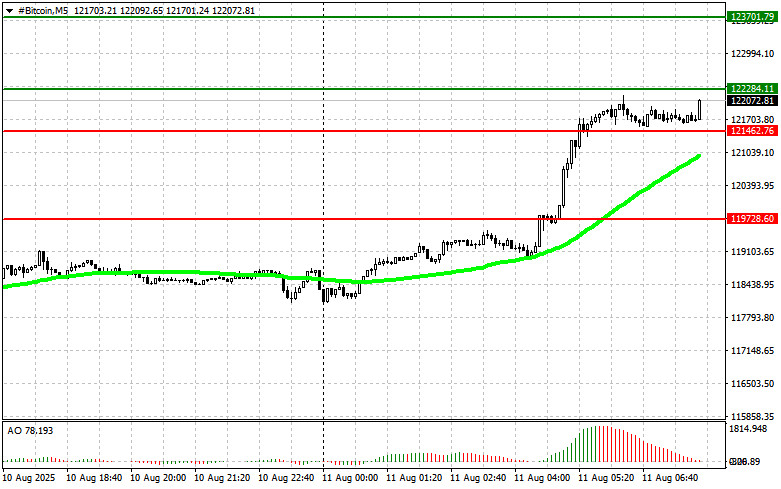

Bitcoin

Buy Scenario

Scenario No. 1: I will buy Bitcoin today if the price reaches around $122,200, aiming for growth to $123,700. At $123,700, I will exit my long positions and sell immediately on the pullback. Before making a purchase on a breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario No. 2: Bitcoin can also be purchased at the lower boundary of $121,400 if there is no market reaction to its breakout. The target would be a rebound toward $122,200 and then $123,700.

Sell Scenario

Scenario No. 1: I plan to sell Bitcoin today if the entry point reaches around $121,400, targeting a decline to $119,700. Once the price hits $119,700, I will exit my short positions and buy immediately on the pullback. Before selling on a breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the zone below zero.

Scenario No. 2: I can also sell Bitcoin from the upper boundary of $122,200 if there is no market reaction to its breakout, aiming for a reversal towards $121,400 and $119,700.

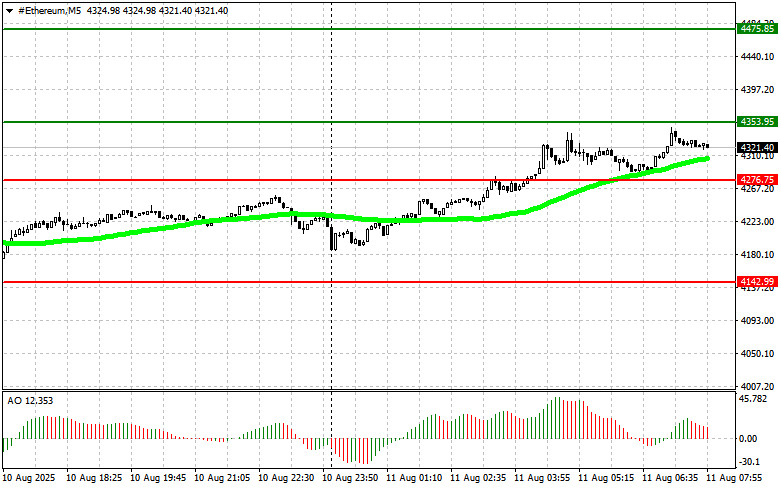

Ethereum

Buy Scenario

Scenario No. 1: I will purchase Ethereum today if the entry point reaches around $4,353, targeting growth to $4,475. When the price hits $4,475, I will exit my long positions and sell immediately on any pullback. Before buying on a breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario No. 2: Ethereum can also be bought at the lower boundary of $4,276 if there is no significant market reaction to its breakout. The target for this trade will be a rebound toward $4,353 and $4,475.

Sell Scenario

Scenario No. 1: I plan to sell Ethereum today if the price reaches around $4,276, targeting a decline to $4,142. Once the price hits $4,142, I will exit my short positions and buy immediately on the pullback. Before selling during a breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the zone below zero.

Scenario No. 2: I may also sell Ethereum from the upper boundary of $4,353 if there is no market reaction to its breakout, aiming for a reversal toward $4,276 and $4,142.