Analysis of Trades and Trading Tips for the Japanese Yen

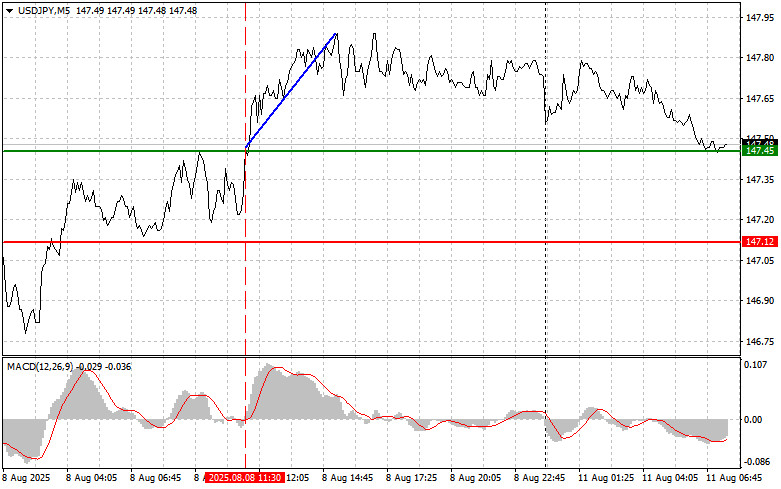

The test of the 147.45 price level occurred when the MACD indicator had just started moving upward from the zero mark, which confirmed the correct entry point for buying the dollar and resulted in a rise of more than 45 points.

The USD/JPY pair rose in response to the speech by Federal Reserve representative Alberto Musalem. This happened despite growing disagreements among committee members regarding the future path of interest rates. This split is most likely the result of a mixed macroeconomic situation, where persistent inflation is occurring alongside signs of a weakening labor market. In such unpredictable conditions, investors seem to be waiting for clearer guidance from the Fed's leadership before adjusting their strategies. Musalem's comments, in turn, were perceived as restrained and lacking fresh information that could influence market sentiment. In such a situation, the speech of a less influential Fed representative—even with important statements—can easily be lost in the overall flow of information.

Given today's lack of significant fundamental data from both Japan and the U.S., the pair's upward potential is likely to remain, but we will probably still see some notable corrections, so be prepared for that.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

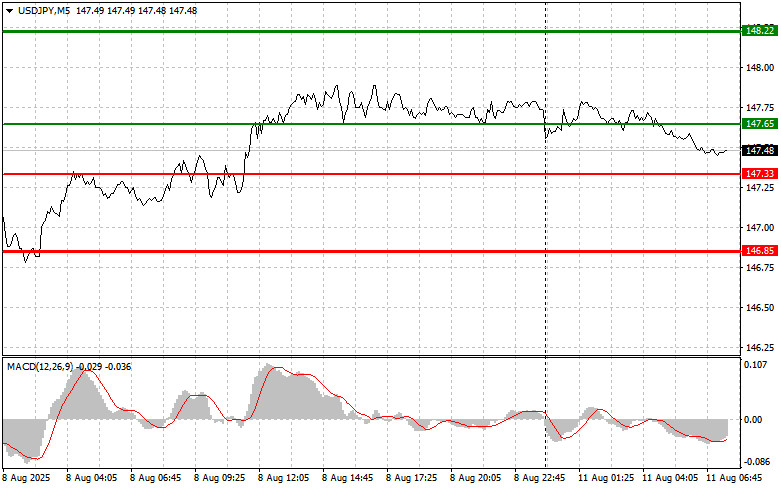

Scenario No. 1: I plan to buy USD/JPY today if the entry point is reached around 147.65 (green line on the chart) with the goal of rising to 148.22 (thicker green line on the chart). Around 148.22, I plan to close long positions and open short positions in the opposite direction, aiming for a 30–35-point move from that level. It is best to return to buying the pair on pullbacks and significant declines in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the case of two consecutive tests of the 147.33 price level when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. Growth toward the opposite levels of 147.65 and 148.22 can be expected.

Sell Scenario

Scenario No. 1: I plan to sell USD/JPY today only after it breaks below the 147.33 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 146.85, where I plan to close short positions and immediately open long positions in the opposite direction, aiming for a 20–25-point move from that level. It is best to sell from higher levels. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the case of two consecutive tests of the 147.65 price level when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 147.33 and 146.85 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.