GBP/USD 5-Minute Analysis

The GBP/USD currency pair also traded higher on Tuesday, but this movement was driven not only by the U.S. inflation report but also by UK data. We cannot say that the British reports were outstanding, but they did not disappoint, as they often do, which was already a positive. The number of jobless claims even turned out to be negative. Thus, the pound sterling began to rise steadily from the morning, maintaining an upward trend on the hourly chart. We have already discussed the U.S. inflation report. Its outcome had no real significance for the Federal Reserve's future rate decision, but at the same time, low inflation increases the likelihood of monetary policy easing not only in September.

From a technical perspective, everything also looks ideal. The upward trend on the hourly chart is part of the broader uptrend on the daily chart, which has been forming since the start of the year. Therefore, given the fundamentals and the macroeconomic background, we expect only further weakness of the U.S. currency.

On the 5-minute chart early in the morning, the pound sterling rebounded perfectly from the 1.3420 level, allowing traders to open long positions. For almost the entire day, the British currency kept rising. At the time of the U.S. inflation release, the price was just 25 pips from the signal formation point. Therefore, a Stop Loss should have been moved to break-even on this trade, but it was not triggered, as the price continued to rise. Shortly after, the price reached the 1.3509 level, where longs could have been closed without hesitation.

COT Report

COT reports on the British pound show that in recent years, the sentiment of commercial traders has been constantly changing. The red and blue lines representing net positions of commercial and non-commercial traders frequently cross and, in most cases, remain close to the zero mark. Right now, they have converged again, indicating an approximately equal number of buy and sell positions.

The dollar continues to fall due to Donald Trump's policies, so in principle, the demand of market makers for the pound is not particularly important at this point. The trade war will continue in one form or another for a long time, and demand for the dollar will keep falling. According to the latest report on the British pound, the "Non-commercial" group closed 22,100 BUY contracts and 900 SELL contracts. As a result, the net position of non-commercial traders decreased by 21,200 contracts over the reporting week.

In 2025, the pound experienced a sharp rise, primarily due to Trump's policies. Once this factor is removed, the dollar may resume growth, but no one knows when that will happen. It doesn't matter how quickly the net position in the pound is rising or falling — in the dollar, it is falling in any case, and usually at a faster pace.

GBP/USD 1-Hour Analysis

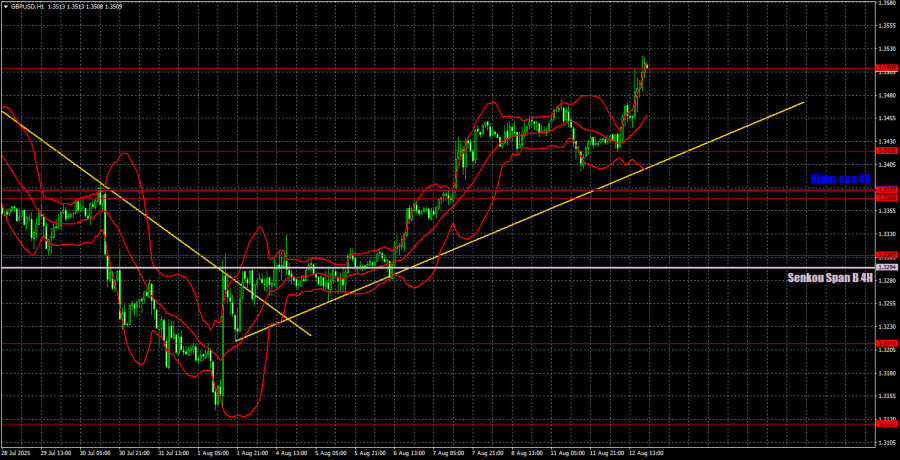

On the hourly timeframe, the GBP/USD pair continues forming its upward trend, and on the daily chart, it has bounced from the important and strong Senkou Span B line. In our view, the fundamental background remains unfavorable for the U.S. currency; therefore, in the long term, we expect the continuation of the "2025 trend." Recent news and events have only added to the pressure on the U.S. dollar.

For August 13, we highlight the following key levels: 1.3125, 1.3212, 1.3369–1.3377, 1.3420, 1.3509, 1.3615, 1.3681, 1.3763, 1.3833, 1.3886. The Senkou Span B line (1.3294) and the Kijun-sen line (1.3377) can also serve as signal sources. A Stop Loss is recommended to be moved to breakeven if the price moves 20 pips in the right direction. The Ichimoku indicator lines may shift during the day, which should be considered when identifying trading signals.

On Wednesday, no important events are scheduled in either the UK or the U.S. However, Friday will bring negotiations between U.S. and Russian leaders in Alaska, which could potentially end the Ukraine–Russia conflict.

Trading Recommendations

We believe that volatility in the pair may be low on Wednesday, as there will be no macroeconomic background. If the price breaks above 1.3509, traders can open new longs, though strong growth is unlikely. A rebound from 1.3509 will allow opening shorts with a target at 1.3420, but a strong drop in the pair is also doubtful.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.