Analysis of Trades and Trading Tips for the British Pound

The test of the 1.3464 price level occurred when the MACD indicator had just begun moving upward from the zero mark, confirming the correct entry point for buying the pound and resulting in an increase of more than 59 pips.

Following the release of consumer price index data showing a moderate rise in prices, the market reacted with optimism. The GBP/USD pair continued to climb amid a weakening dollar, as the Federal Reserve has fewer and fewer arguments for keeping rates unchanged. The rise in GBP/USD was seen as a signal of a possible softening in the Fed's rhetoric regarding future interest rates. However, it should be noted that core inflation, excluding volatile food and energy prices, while showing signs of stabilizing, still exceeds the Fed's target level. This means the central bank will likely continue to monitor economic indicators closely and, if necessary, be prepared to take further action to contain inflationary pressure.

Unfortunately, today's UK economic calendar is empty, giving buyers opportunities to develop the GBP/USD uptrend further. The lack of macroeconomic data from the UK creates a sort of vacuum, allowing speculative sentiment and technical analysis to dominate the market. In such conditions, pound buyers may feel more confident, aiming for new monthly highs in continuation of the prevailing upward trend.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

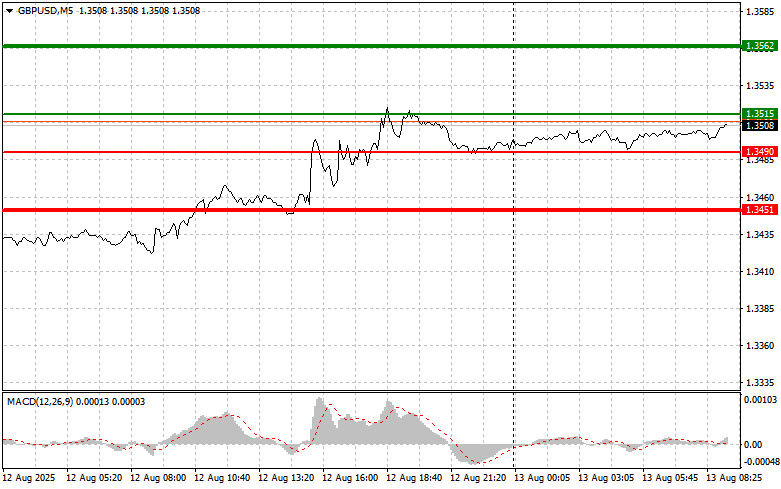

Scenario No. 1: Today, I plan to buy the pound upon reaching the entry point around 1.3515 (green line on the chart), targeting a rise to 1.3562 (thicker green line on the chart). Around 1.3562, I plan to exit buy positions and open sell trades in the opposite direction, aiming for a 30–35 pip move down from the level. Buying the pound today is justified in continuation of the bullish trend. Important! Before buying, make sure the MACD indicator is above the zero mark and has just begun to rise from it.

Scenario No. 2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3490 price level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. A rise toward the opposite levels of 1.3515 and 1.3562 can be expected.

Sell Scenario

Scenario No. 1: I plan to sell the pound today after the 1.3490 level (red line on the chart) is updated, which will likely lead to a rapid decline in the pair. The key target for sellers will be 1.3451, where I plan to exit sell positions and immediately open buy trades in the opposite direction, aiming for a 20–25 pip move upward from the level. Selling the pound today should only be considered after weak data. Important! Before selling, make sure the MACD indicator is below the zero mark and has just begun to decline from it.

Scenario No. 2: I also plan to sell the pound today if there are two consecutive tests of the 1.3515 price level while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a downward market reversal. A decline toward the opposite levels of 1.3490 and 1.3451 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.