Bitcoin started the new week with an active decline toward 115,000. Following the weekend, with no significant buying in the cryptocurrency market and Bitcoin failing to consolidate above 118,000, traders continued to take profits. To be fair, the decline spread across the entire market, affecting Ethereum as well as other major tokens and altcoins.

Meanwhile, according to an August study conducted by BofA, three-quarters of surveyed asset managers are still refraining from investing in cryptocurrencies. This reflects ongoing uncertainty and concerns related to market volatility, regulatory risks—though somewhat reduced—and the lack of clear rules. Nevertheless, the quarter of managers actively engaged in crypto investments signals growing interest in digital assets, especially among younger investors and funds focused on innovative technologies.

One of the main reasons for restraint is the difficulty in valuing cryptocurrencies. Traditional valuation methods applied to stocks and bonds are not always applicable to digital assets, making it harder to determine fair value and return potential. In addition, persistent regulatory uncertainty creates extra risks for investors, as legislative changes can significantly affect the value and liquidity of cryptocurrencies.

At the same time, the growing number of institutional investors showing interest in cryptocurrencies demonstrates recognition of their potential as an asset class. The development of infrastructure, including custodial services and regulated exchanges, helps reduce risks and increases confidence in the market.

However, the low percentage of managers involved in cryptocurrencies is viewed as a positive signal for the future of the crypto market. The currently small share of institutional capital suggests significant potential for inflows in the future. Factors such as clarification of regulations, momentum provided by the Trump administration, innovative blockchain technology, the continuing novelty of the trend, and marketing efforts by major players such as BlackRock, Bitwise, and Strategy are fueling institutional and corporate interest in cryptocurrencies.

As for the intraday strategy in the cryptocurrency market, I will continue to act based on any major pullbacks in Bitcoin and Ethereum, counting on the continuation of the medium-term bull market, which is still intact.

For short-term trading, the strategy and conditions are described below.

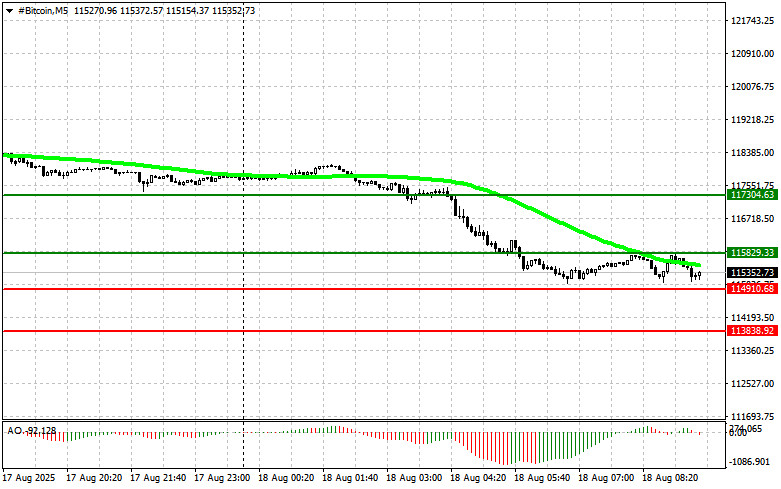

Bitcoin

Buy Scenario

Scenario 1: I plan to buy Bitcoin today at the entry point around 115,800 with a target at 117,300. Around 117,300, I will exit my buys and sell immediately on the rebound. Before buying on a breakout, it is important to make sure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario 2: Bitcoin can also be bought from the lower boundary of 114,900 if there is no market reaction to its breakout, with an upward move expected back to 115,800 and 117,300.

Sell Scenario

Scenario 1: I plan to sell Bitcoin today at the entry point around 114,900 with a target at 113,800. Around 113,800, I will exit my sells and buy immediately on the rebound. Before selling on a breakout, it is important to make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario 2: Bitcoin can also be sold from the upper boundary of 115,800 if there is no market reaction to its breakout, with a downward move expected back to 114,900 and 113,800.

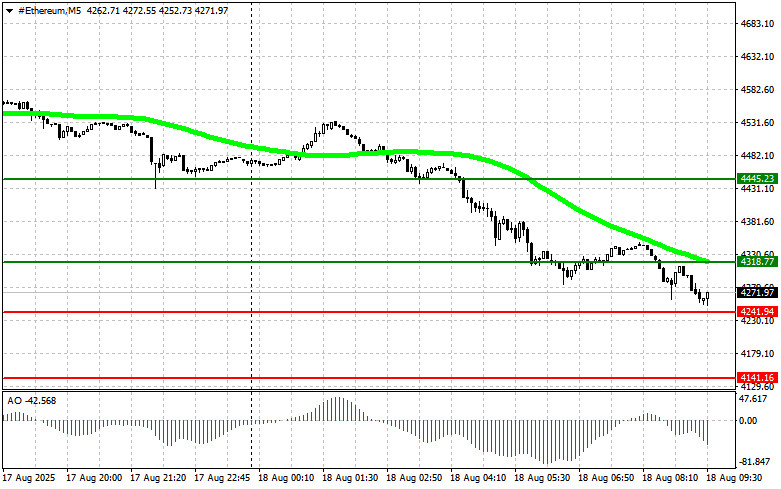

Ethereum

Buy Scenario

Scenario 1: I plan to buy Ethereum today at the entry point around 4,318 with a target at 4,445. Around 4,445, I will exit buys and sell immediately on the rebound. Before buying on a breakout, it is important to make sure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario 2: Ethereum can also be bought from the lower boundary of 4,241 if there is no market reaction to its breakout, with an upward move expected back to 4,318 and 4,445.

Sell Scenario

Scenario 1: I plan to sell Ethereum today at the entry point around 4,241 with a target at 4,141 dollars. Around 4,141, I will exit sells and buy immediately on the rebound. Before selling on a breakout, it is important to make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario 2: Ethereum can also be sold from the upper boundary of 4,318 if there is no market reaction to its breakout, with a downward move expected back to 4,241 and 4,141.