Trade Review and Tips on the British Pound

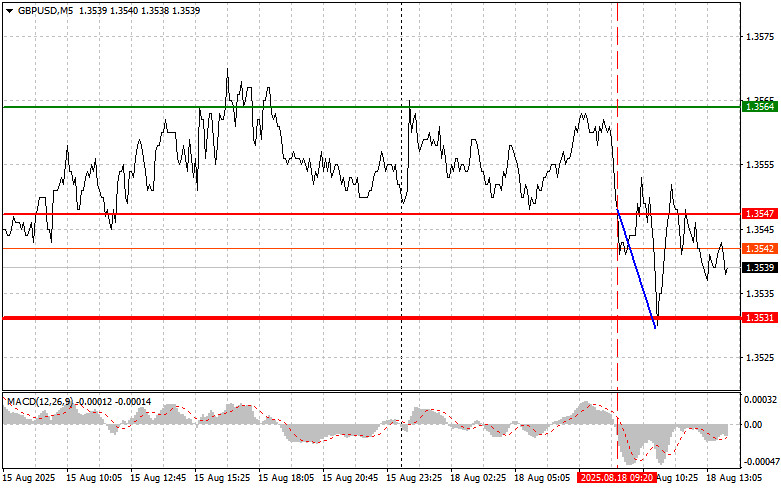

The test of 1.3547 coincided with the MACD indicator just starting to move down from the zero line, which confirmed the correct entry point for selling the pound and led to a decline of more than 20 points. Buying on a rebound from 1.3530 also brought about 12 additional points.

The absence of U.K. statistics supported pound sellers. Most likely, the pound's correction is driven by overall uncertainty in currency markets and a temporary decline in risk appetite. Now that concerns about U.S. inflation have somewhat eased, investors have again shifted focus to the Federal Reserve's next steps. In this context, any hints of a softer Fed stance will provide support for the pound.

Today, in the second half of the day, attention will turn to the release of the U.S. NAHB housing market index. This indicator, which reflects homebuilders' optimism regarding new home sales, serves as an important gauge of the health of the U.S. housing market. Analysts' forecasts vary, but most expect a slight decline in the index. If this scenario materializes, it will provide further confirmation of weakening activity in the construction sector, driven by rising mortgage rates and overall economic instability. The expected impact on financial markets is seen as limited, provided the results match forecasts. However, a significant deviation from expectations could trigger volatility. Positive figures, indicating stability in the housing market, could strengthen the U.S. dollar. Conversely, negative results, pointing to a worsening situation, may heighten recession fears and prompt capital flows into alternative assets. Overall, the NAHB housing market index is one of many indicators used by investors and economists to assess the condition of the U.S. economy.

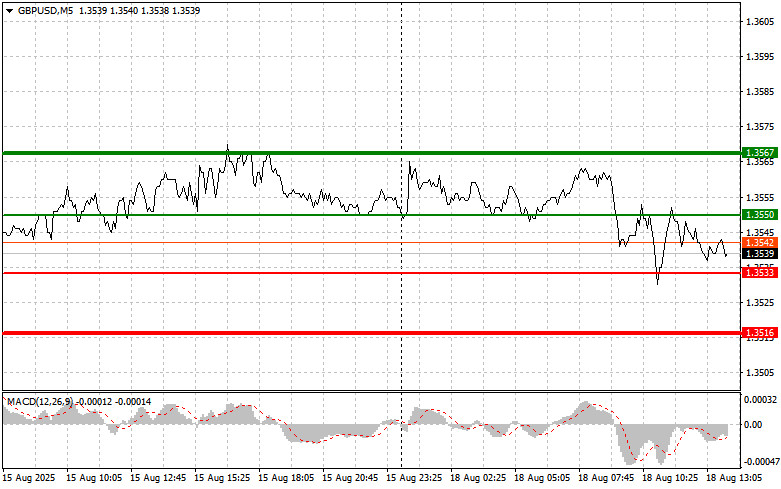

As for intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today at the entry point around 1.3550 (green line on the chart), targeting growth toward 1.3567 (thicker green line on the chart). Around 1.3567, I will exit purchases and open sales in the opposite direction (expecting a move of 30–35 points in the opposite direction from that level). A strong rally in the pound is unlikely today.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to move upward.

Scenario #2: I also plan to buy the pound in case of two consecutive tests of 1.3533 while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth toward 1.3550 and 1.3567 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after updating the 1.3533 level (red line on the chart), which will lead to a quick decline of the pair. The key target for sellers will be 1.3516, where I will exit sales and immediately open purchases in the opposite direction (expecting a rebound of 20–25 points in the opposite direction from that level). Sellers may push the pound even lower, but strong statistics will be needed.Important! Before selling, make sure the MACD indicator is below the zero line and just starting to move downward.

Scenario #2: I also plan to sell the pound in case of two consecutive tests of 1.3550 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward 1.3533 and 1.3516 can be expected.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – assumed price for placing Take Profit or manually securing profit, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – assumed price for placing Take Profit or manually securing profit, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones.

Important. Beginner Forex traders must be very cautious in making entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not apply money management and trade large volumes.

And remember, successful trading requires a clear trading plan like the one I outlined above. Spontaneous decisions based on current market moves are an inherently losing strategy for intraday traders.