Bitcoin yesterday attempted to recover from the level of $114,500, and it seems the attempt was quite successful. During today's Asian trading, there was even an attempt to rise above $117,000, but this turned into another major sell-off, with the price updating to $114,300.

Meanwhile, according to the latest Strategy report, the company purchased an additional 430 BTC at an average price of $119,666 per BTC. In total, the company now holds 629,376 BTC on its balance sheet, acquired at an average price of $73,320 per coin.

Another purchase, even at historical highs, clearly demonstrates the company management's unwavering belief in the long-term potential of the cryptocurrency, despite current market fluctuations. The average acquisition cost, even after the latest purchase at a significantly higher price, remains at an attractive level, which allows the company to stay in a favorable position in case of further Bitcoin price growth. Moreover, such a significant volume of cryptocurrency on the company's balance sheet makes it one of the largest Bitcoin holders in the world, strengthening its market position and influencing the overall dynamics of the crypto community. This amount of BTC may also serve as a strategic reserve, enabling the company to use it for financing future projects, investments, or even as a hedge against inflation.

One cannot exclude the speculative component associated with such a large Bitcoin holding. The company is likely expecting substantial cryptocurrency price growth in the future, which would allow it to secure significant profits from its investments. However, it is also important to remember the risks linked to cryptocurrency market volatility, which could result in heavy losses in the event of an unfavorable scenario.

As for the intraday strategy on the cryptocurrency market, I will continue to act based on major Bitcoin and Ethereum pullbacks, anticipating further development of the medium-term bullish market, which is still intact.

For short-term trading, the strategy and conditions are described below.

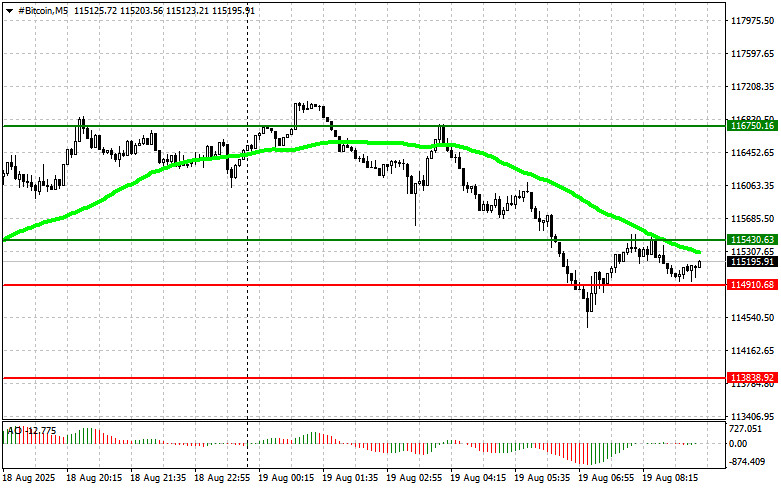

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today upon reaching the entry point around $115,400, targeting growth toward $116,700. Once the price reaches around $116,700, I will exit my long positions and sell immediately on a rebound. Before buying on a breakout, it is necessary to confirm that the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario #2: Bitcoin purchases can be considered from the lower boundary at $114,900 if there is no market reaction to its breakout, with a move back toward $115,400 and $116,700.

Sell Scenario

Scenario #1: I will sell Bitcoin today upon reaching the entry point around $114,900, targeting a decline to $113,800. Once the price reaches around $113,800, I will exit my short positions and buy immediately on a rebound. Before selling on a breakout, it is necessary to confirm that the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario #2: Bitcoin sales can be considered from the upper boundary at $115,400 if there is no market reaction to its breakout, with a move back toward $114,900 and $113,800.

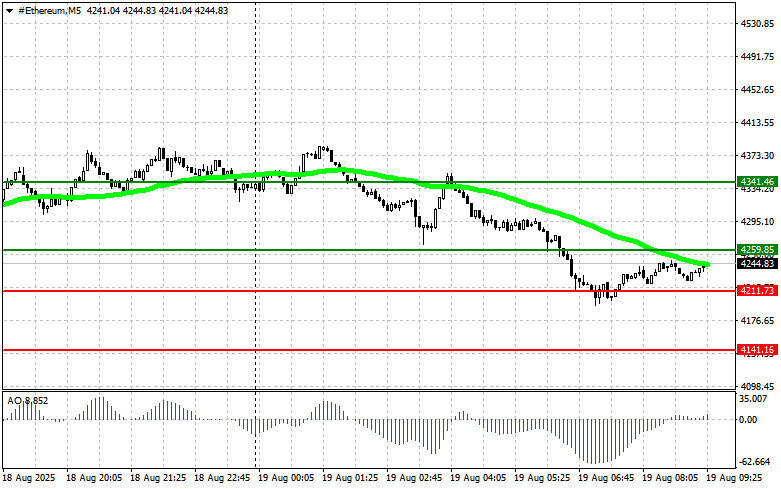

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today upon reaching the entry point around $4,259, targeting growth toward $4,341. Once the price reaches around $4,341, I will exit my long positions and sell immediately on a rebound. Before buying on a breakout, it is necessary to confirm that the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario #2: Ethereum purchases can be considered from the lower boundary at $4,211 if there is no market reaction to its breakout, with a move back toward $4,259 and $4,341.

Sell Scenario

Scenario #1: I will sell Ethereum today upon reaching the entry point around $4,211, targeting a decline to $4,141. At around $4,141, I will exit my short positions and buy immediately on a rebound. Before selling on a breakout, it is necessary to confirm that the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario #2: Ethereum sales can be considered from the upper boundary at $4,259 if there is no market reaction to its breakout, with a move back toward $4,211 and $4,141.