Analysis of Trades and Trading Tips for the Euro

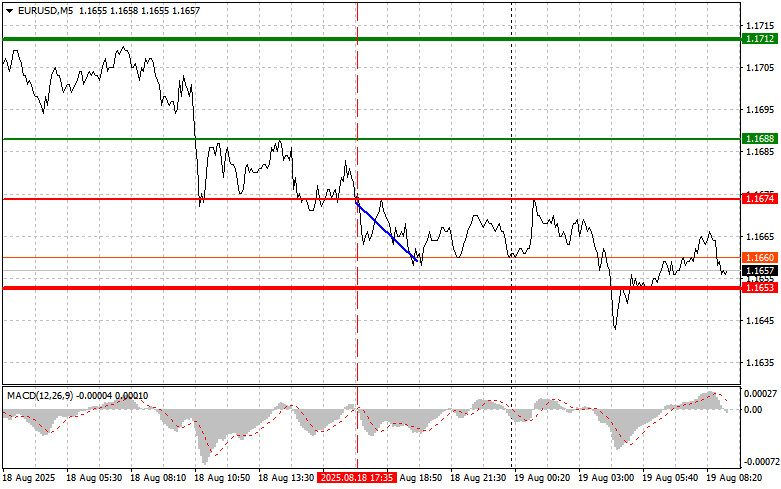

The price test of 1.1674 coincided with the moment when the MACD indicator had just begun moving downward from the zero mark, confirming the correct entry point for selling the euro. As a result, the pair dropped by 20 points.

Yesterday was marked by a rise in the dollar against the European currency, even in the absence of important macroeconomic reports from the United States. The likely reason for this dynamic was the three-way meeting between Donald Trump, Volodymyr Zelensky, and representatives of the European Union. Market participants interpreted this event as a sign of potential improvement in the global geopolitical situation, which in turn made the U.S. dollar more attractive as a safe-haven asset. However, further direction will be determined by data and key fundamental factors. Market attention will also be focused on upcoming speeches by representatives of the U.S. Federal Reserve.

As for the first half of the day, the European Central Bank will release data on the current account balance. This indicator, reflecting the difference between capital inflows and outflows, serves as an important barometer of the eurozone's economic health. A positive balance, where inflows exceed outflows, signals the region's investment appeal and usually supports the euro. A negative balance, on the other hand, can weaken the European currency. Economists are predicting a slight increase in the positive balance compared to the previous reporting period.

Nevertheless, even a slight decline will not necessarily trigger a sharp fall in the euro. The key factor will be the market's reaction to the published data. If the figures turn out better than expected, the euro may strengthen temporarily. Otherwise, a rise in bearish sentiment is quite possible.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

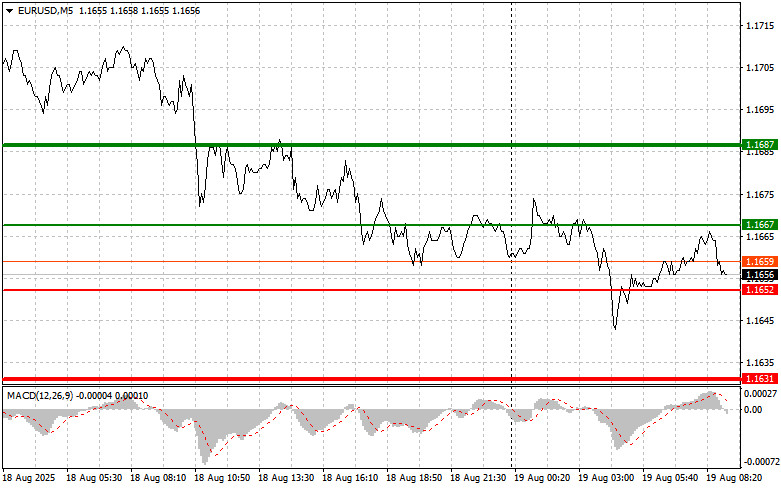

Scenario #1: Today, buying the euro is possible once the price reaches around 1.1667 (green line on the chart), targeting growth toward 1.1687. At 1.1687, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35-point move from the entry point. One should only count on euro growth after very strong data. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1652 price level, specifically when the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to an upward reversal. Growth toward the opposite levels of 1.1667 and 1.1687 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after the price reaches 1.1652 (red line on the chart). The target will be 1.1631, where I intend to exit the market and immediately buy in the opposite direction (looking for a 20–25-point reversal from that level). Pressure on the pair may persist today. Important! Before selling, ensure the MACD indicator is below the zero mark and is just beginning to move downward from it.

Scenario #2: I also plan to sell the euro today if it tests the 1.1667 price level twice consecutively, especially when the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1652 and 1.1631 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.