The EUR/USD currency pair on Tuesday (as in recent days) traded in an ultra-calm manner. On Monday, it declined, on Tuesday, it grew slightly, but overall, recent moves have taken place within roughly the same price range. In essence, the price is stuck in one place. And we all know that any flat phase is a precursor to a new trend.

Many traders and even analysts very often make the same mistake. They try to explain the inexplicable. For example, what have we seen in recent days? Weak movements one way and then the other. Macroeconomic or fundamental events should not even explain such movements. It should be remembered that in the currency market, trades are made by major players for millions and billions of dollars (and other currencies). Deals are not made only on news, since the foreign exchange market is not only a place for speculators seeking profit from exchange rate differences.

And then we see a 50-pip move and immediately try to justify it. Why? Why constantly give explanations like "growth in risk appetite," "growth in risk aversion," "increasing probability of a rate cut," "declining probability of a rate hike." There are specific events that influence market sentiment. If there are no such events, then why invent them?

Thus, a straightforward point must be understood: banal pauses are also possible in the market. Trading volumes fall, and why that happens is not important. What matters is that volumes are now low, and there is no fundamental or macroeconomic backdrop. Over the weekend, there was hope that progress in peace negotiations on the conflict in Ukraine would provoke a reaction from traders. However, by Wednesday, it became clear—the market chose to ignore this topic for now.

It could have ignored it for various reasons. For example, to wait for official agreements between Ukraine and Russia, not between Russia and the U.S., or the U.S. and Ukraine. Everyone understands that after 3.5 years of military actions, it is Kyiv and Moscow who must reach an agreement, not Washington with the rest of the world. And market participants quite possibly doubt that a truce is realistic. The fact is that the media produces a massive amount of information. Each source provides its version, usually contradicting another source. U.S., Ukrainian, and Russian officials say one thing, EU leaders express their position as if it were their conflict, various media outlets regularly cite insiders claiming something else, and in all this "mess," it is extremely difficult to discern the truth.

Therefore, we believe that no one in the market wants to "run ahead of the train" right now. Why rush if you can wait? Yes, the market often tries to price in an event in advance, "ahead of time." But that does not always happen. The key point is that the global fundamental backdrop for the dollar is unchanged, while the euro, pound, and other currencies remain just spectators in the show called "Destruction of the Dollar." Thus, we believe that the U.S. currency will continue to remain under strong market pressure. One should simply understand that this does not mean the dollar must fall every single day.

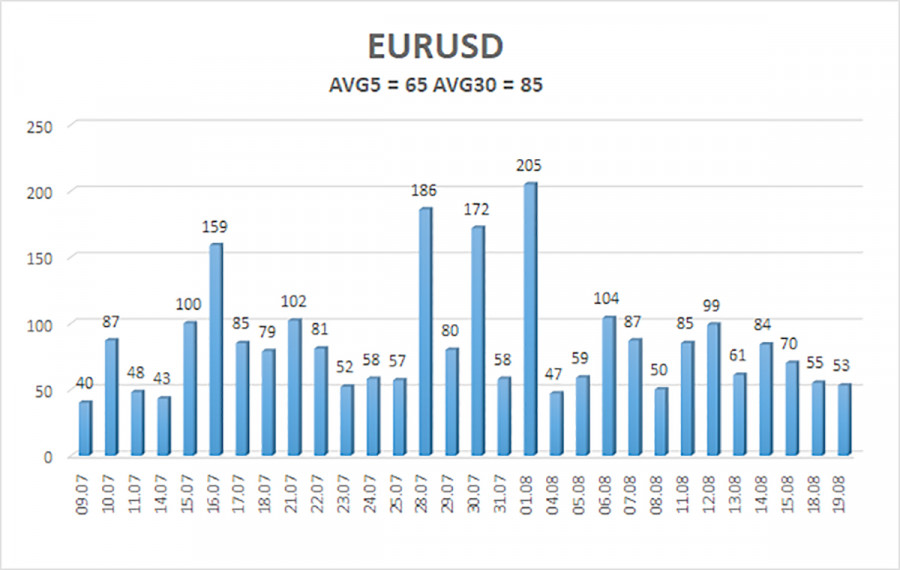

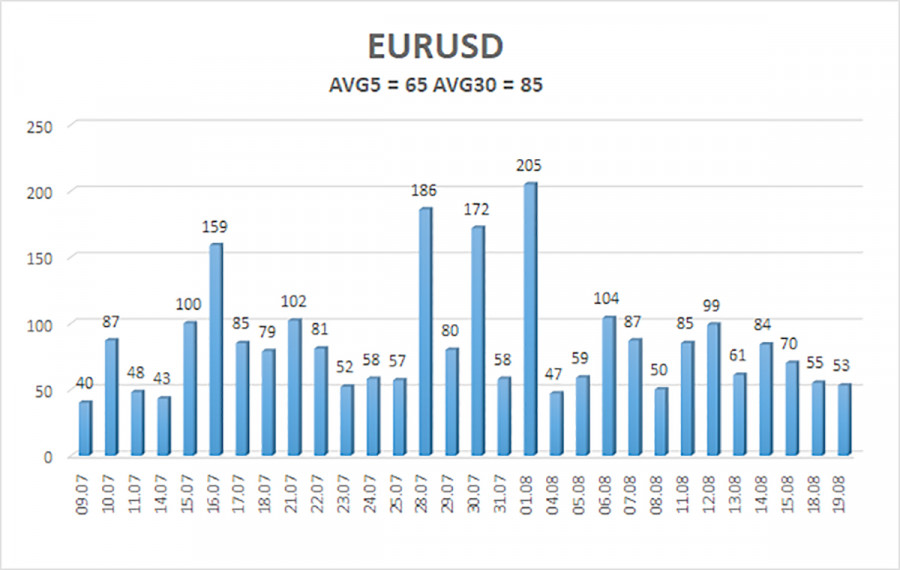

The average volatility of EUR/USD over the past five trading days as of August 20 is 65 pips, which is characterized as "moderate." We expect the pair to move between the levels of 1.1597 and 1.1727 on Wednesday. The long-term linear regression channel is directed upward, which still indicates an upward trend. The CCI indicator has entered the oversold area three times, warning of a resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair may resume its upward trend. The U.S. currency continues to be strongly influenced by Donald Trump's policies, and he has no intention of "stopping where he is." The dollar has grown as much as it could, but now it seems the time for a new prolonged decline has come. If the price is below the moving average, small short positions may be considered with targets of 1.1597 and 1.1536. Above the moving average line, long positions remain relevant with targets of 1.1719 and 1.1780 in continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.