Review of trades and tips on trading the Japanese yen

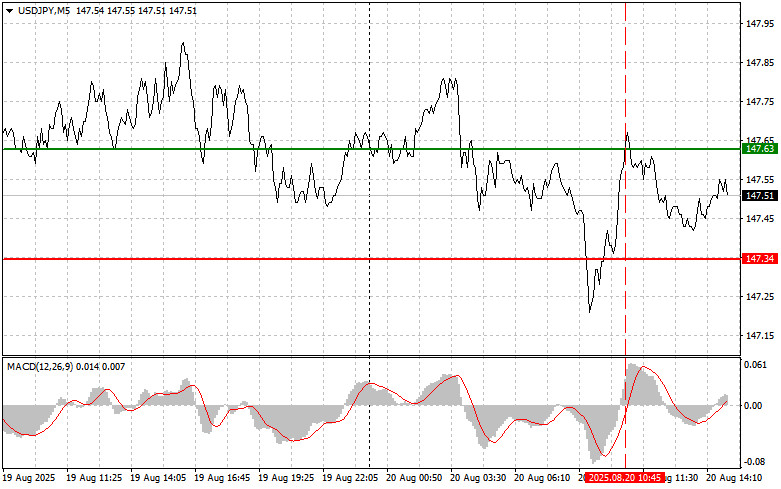

The test of the 147.63 level occurred when the MACD indicator had already moved far above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the dollar.

The key events of the second half of the day for currency trading will be the release of the minutes of the latest Federal Reserve meeting and the speeches of FOMC members Christopher Waller and Raphael Bostic. Investors are closely watching the details of the discussions about the future direction of U.S. monetary policy, which strongly influences the dollar's trajectory. Particular attention will be focused on nuances regarding inflation risks and labor market prospects. The published minutes will allow a deeper look into divergences within the FOMC and help assess the Fed's determination to continue tightening policy. Market participants will also try to identify signs of a possible start to the rate-cutting cycle, which would weaken the dollar. Otherwise, the USD/JPY pair could rise considerably.

The speeches of Waller and Bostic will provide insights into the current state of the economy from the perspective of individual Fed officials. Their remarks on inflation, economic growth, and employment prospects could have a significant impact on investor expectations and currency pair dynamics. Any unexpected signals or differences in their positions may trigger sharp market fluctuations. Traders are advised to remain cautious and factor in potential risks when making decisions.

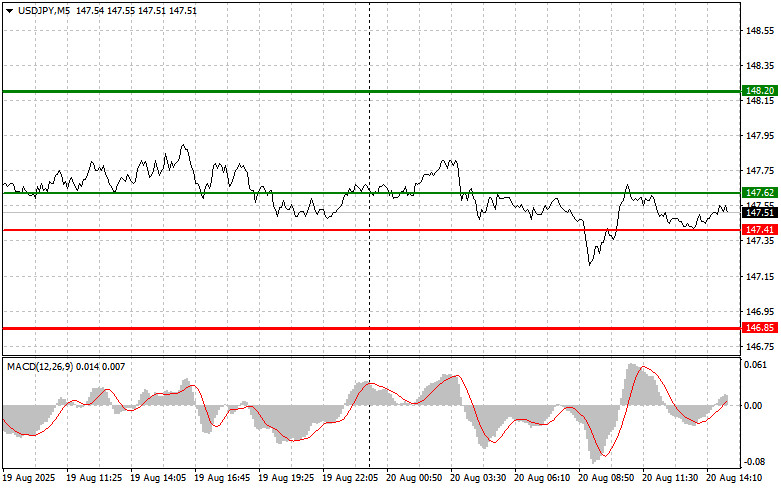

As for the intraday strategy, I will rely mainly on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy USD/JPY at the entry point around 147.62 (green line on the chart), targeting growth toward 148.20 (thicker green line on the chart). Around 148.20, I will exit purchases and open sales in the opposite direction, expecting a 30–35 point reversal from that level. A modest rise in the pair can be expected if the Fed takes a hawkish stance.Important! Before buying, make sure the MACD indicator is above zero and just starting to move upward.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 147.41 level while the MACD indicator is in the oversold area. This would limit the pair's downward potential and trigger a reversal upward. Growth toward 147.62 and 148.20 can then be expected.

Sell Signal

Scenario #1: Today, I plan to sell USD/JPY after a breakout of the 147.41 level (red line on the chart), which would trigger a quick decline in the pair. The key target for sellers will be 146.85, where I will exit sales and also immediately open purchases in the opposite direction, expecting a 20–25 point rebound. Pressure on the pair will return if the Fed adopts a dovish stance.Important! Before selling, make sure the MACD indicator is below zero and just starting to move downward.

Scenario #2: I also plan to sell USD/JPY if there are two consecutive tests of the 147.62 level while the MACD indicator is in the overbought area. This would cap the pair's upward potential and trigger a reversal downward. A decline toward 147.41 and 146.85 can then be expected.

Chart Notes

- Thin green line – entry price for buying the instrument;

- Thick green line – suggested level for placing Take Profit or fixing profit, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – suggested level for placing Take Profit or fixing profit, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner Forex traders must be very cautious when making entry decisions. Ahead of major fundamental reports, it is best to stay out of the market to avoid sharp fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one presented above. Spontaneous decisions based on the current market situation are by default a losing strategy for an intraday trader.