Analysis of Trades and Trading Tips for the British Pound

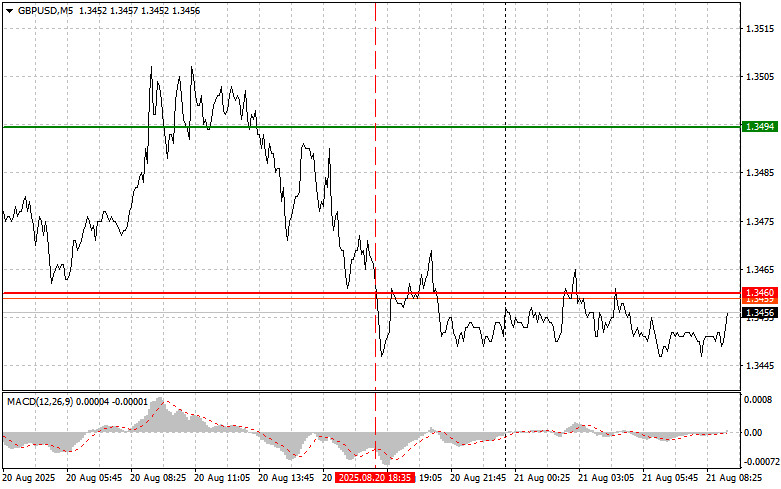

The test of the 1.3460 price level occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's further downside potential. For this reason, I did not sell the pound.

The Federal Reserve minutes released after the July 29–30 meeting confirmed a consensus among nearly all participants in favor of keeping the base interest rate in the range of 4.25–4.50%, which weakened the pound and triggered dollar buying. This decision reflects the prevailing view that the risk of uncontrolled inflation currently poses a greater threat to the economy than a potential rise in unemployment. However, despite this broad consensus, the minutes also highlighted certain nuances. Some participants expressed concern about the possible consequences of high interest rates for economic growth. They emphasized the need for close monitoring of incoming data to adjust policy in a timely manner should the macroeconomic situation worsen.

The further direction of the pair will be determined by the UK Services PMI and the composite PMI for August. Reports will also be released on the net public sector borrowing and the Confederation of British Industry (CBI) industrial trends survey. Particular attention will be paid to the PMI indices, as they serve as leading indicators of the country's economic health. A decline in these indicators could signal slower growth, which in turn could put pressure on the pound sterling. Specifically, readings below 50 points indicate a contraction in business activity, raising concerns about the outlook for the UK economy.

The net public sector borrowing report is also important, as it reflects the state of public finances. An increase in borrowing may point to government financial difficulties and, consequently, could undermine investor confidence in the pound.

The CBI industrial trends survey provides insight into sentiment in the industrial sector. Improvement in this indicator may signal a recovery in the industry, which in turn could support the pound sterling.

Taken together, all these data will give investors a more complete picture of the current state of the UK economy and allow them to assess its outlook. Market reaction will depend on how closely the data align with expectations and what signals they send regarding the Bank of England's future policy.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

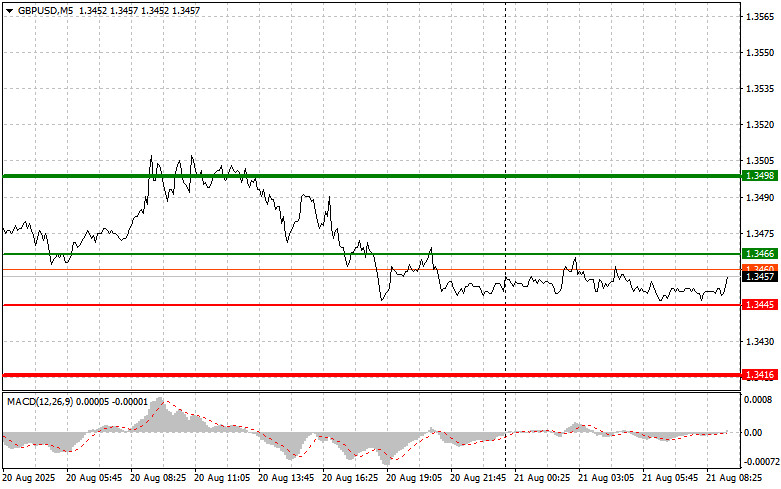

Scenario No. 1: I plan to buy the pound today if the entry point around 1.3466 is reached (green line on the chart), targeting growth toward 1.3498 (thicker green line on the chart). Around 1.3498, I plan to exit purchases and open sell positions in the opposite direction, expecting a move of 30–35 points from that level. A rise in the pound today can only be expected after strong data. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in case of two consecutive tests of the 1.3445 price level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. A rise toward the opposite levels of 1.3466 and 1.3498 can be expected.

Sell Scenario

Scenario No. 1: I plan to sell the pound today after the price updates the 1.3445 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the 1.3416 level, where I plan to exit sales and immediately open buy positions in the opposite direction, expecting a rebound of 20–25 points from that level. Sellers will return to the pound today if the data is weak. Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to move downward from it.

Scenario No. 2: I also plan to sell the pound today in case of two consecutive tests of the 1.3466 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.3445 and 1.3416 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.